In Colorado, a beneficiary deed, also known as a "transfer on death" (TOD) deed, is a type of deed that allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate. This can be a valuable tool for estate planning, as it can help avoid the costs, delays, and publicity associated with probate proceedings. Here are five ways to use a beneficiary deed in Colorado:

Colorado law allows property owners to use beneficiary deeds to transfer their real estate to beneficiaries upon their death. This type of deed is also known as a "transfer on death" (TOD) deed. Beneficiary deeds are revocable, meaning that the property owner can change or revoke the deed at any time during their lifetime. This provides flexibility and control over the transfer of the property.

One of the primary benefits of using a beneficiary deed in Colorado is that it allows property owners to avoid probate. Probate is the court-supervised process of settling an estate after someone's death. It can be time-consuming, expensive, and public. By using a beneficiary deed, property owners can transfer their real estate directly to their beneficiaries, bypassing the probate process.

How Beneficiary Deeds Work in Colorado

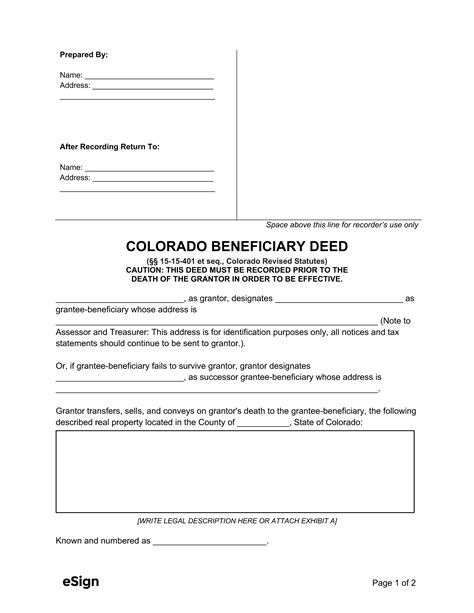

In Colorado, a beneficiary deed is a type of deed that allows property owners to transfer their real estate to beneficiaries upon their death. The deed must be recorded with the county clerk and recorder's office in the county where the property is located. The beneficiary deed must also be signed and notarized by the property owner.

When the property owner dies, the beneficiary deed takes effect, and the property is transferred to the beneficiaries named in the deed. The beneficiaries can then take possession of the property without the need for probate.

Types of Beneficiary Deeds in Colorado

There are two types of beneficiary deeds in Colorado: revocable and irrevocable. A revocable beneficiary deed can be changed or revoked by the property owner at any time during their lifetime. An irrevocable beneficiary deed, on the other hand, cannot be changed or revoked once it is recorded.

In most cases, a revocable beneficiary deed is the preferred choice, as it provides flexibility and control over the transfer of the property.

5 Ways to Use a Beneficiary Deed in Colorado

Now that we have discussed the basics of beneficiary deeds in Colorado, let's explore five ways to use this type of deed:

1. Avoid Probate

As mentioned earlier, one of the primary benefits of using a beneficiary deed in Colorado is that it allows property owners to avoid probate. By transferring the property directly to beneficiaries, property owners can bypass the probate process, saving time, money, and hassle.

2. Transfer Property to Multiple Beneficiaries

Beneficiary deeds in Colorado can be used to transfer property to multiple beneficiaries. This can be useful for property owners who want to divide their property among multiple family members or loved ones.

For example, a property owner can create a beneficiary deed that leaves 50% of the property to one beneficiary and 50% to another beneficiary. This can help avoid disputes and ensure that the property is divided fairly.

3. Transfer Property to a Trust

Beneficiary deeds in Colorado can also be used to transfer property to a trust. This can be useful for property owners who want to create a trust to manage their property and distribute it to beneficiaries.

For example, a property owner can create a beneficiary deed that leaves the property to a trust, which can then be managed by a trustee and distributed to beneficiaries according to the terms of the trust.

4. Transfer Property to a Minor

Beneficiary deeds in Colorado can be used to transfer property to a minor. This can be useful for property owners who want to leave property to a child or grandchild.

However, it's essential to note that minors cannot own property in their own name. Therefore, a property owner may need to create a trust or use a guardian to manage the property until the minor reaches the age of majority.

5. Transfer Property to a Charity

Beneficiary deeds in Colorado can also be used to transfer property to a charity. This can be useful for property owners who want to leave a lasting legacy and support a favorite charity.

For example, a property owner can create a beneficiary deed that leaves the property to a charity, which can then use the property to further its mission and goals.

Conclusion

In conclusion, beneficiary deeds in Colorado offer a convenient and flexible way to transfer property to beneficiaries upon the property owner's death. By avoiding probate, transferring property to multiple beneficiaries, transferring property to a trust, transferring property to a minor, and transferring property to a charity, property owners can use beneficiary deeds to achieve their estate planning goals.

It's essential to note that beneficiary deeds should be used in conjunction with other estate planning tools, such as wills and trusts, to ensure that the property owner's wishes are carried out. Consult with an experienced attorney to determine the best way to use a beneficiary deed in your specific situation.

What is a beneficiary deed in Colorado?

+A beneficiary deed in Colorado is a type of deed that allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate.

How do I create a beneficiary deed in Colorado?

+To create a beneficiary deed in Colorado, you will need to sign and notarize the deed, and then record it with the county clerk and recorder's office in the county where the property is located.

Can I change or revoke a beneficiary deed in Colorado?

+Yes, a beneficiary deed in Colorado can be changed or revoked at any time during the property owner's lifetime.