The Importance of ASC 842 Lease Excel Templates in Simplifying Lease Accounting

The Financial Accounting Standards Board (FASB) introduced Accounting Standards Codification (ASC) 842, Leases, to enhance transparency and comparability in financial reporting. The new standard requires lessees to recognize lease assets and liabilities on their balance sheets, which can be a complex and time-consuming process. To simplify lease accounting and ensure compliance with ASC 842, companies can utilize Lease Excel templates. In this article, we will explore the benefits of using ASC 842 Lease Excel templates and provide a free download link.

What is ASC 842?

ASC 842 is a lease accounting standard that was introduced by the FASB in 2016. The standard aims to increase transparency and comparability in financial reporting by requiring lessees to recognize lease assets and liabilities on their balance sheets. The standard applies to all leases, including operating leases, finance leases, and short-term leases.

Benefits of Using ASC 842 Lease Excel Templates

ASC 842 Lease Excel templates can simplify the lease accounting process in several ways:

- Simplified Lease Classification: ASC 842 Lease Excel templates can help lessees classify their leases as operating or finance leases, which is a critical step in the lease accounting process.

- Automated Lease Accounting: The templates can automate the lease accounting process, reducing the risk of errors and saving time.

- Compliance with ASC 842: ASC 842 Lease Excel templates ensure compliance with the new lease accounting standard, reducing the risk of non-compliance and associated penalties.

- Improved Financial Reporting: The templates can help lessees improve their financial reporting by providing a clear and transparent picture of their lease obligations.

Components of an ASC 842 Lease Excel Template

A typical ASC 842 Lease Excel template includes the following components:

- Lease Classification Worksheet: This worksheet helps lessees classify their leases as operating or finance leases.

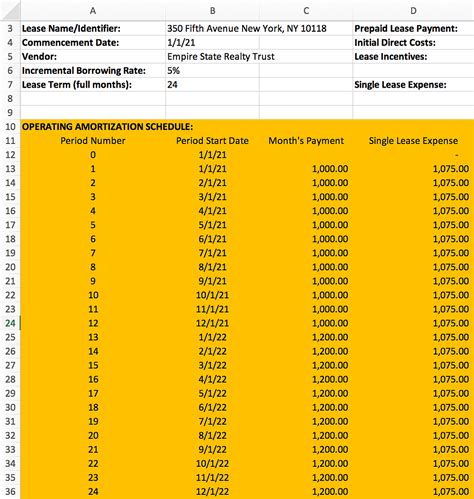

- Lease Amortization Schedule: This schedule calculates the lease asset and liability amortization over the lease term.

- Lease Expense Calculator: This calculator calculates the lease expense for each period.

- Balance Sheet and Income Statement Templates: These templates provide a format for presenting lease assets, liabilities, and expenses on the balance sheet and income statement.

Free ASC 842 Lease Excel Template Download

To help lessees simplify their lease accounting process, we are providing a free ASC 842 Lease Excel template download. The template includes all the necessary components to ensure compliance with ASC 842 and simplify the lease accounting process.

[Insert Image: ASC 842 Lease Excel Template Screenshot]

Download Link: [Insert Download Link]

How to Use the ASC 842 Lease Excel Template

To use the ASC 842 Lease Excel template, follow these steps:

- Download the Template: Download the ASC 842 Lease Excel template from the link provided above.

- Enter Lease Data: Enter your lease data, including lease term, lease payments, and discount rates.

- Classify Leases: Use the lease classification worksheet to classify your leases as operating or finance leases.

- Calculate Lease Amortization: Use the lease amortization schedule to calculate the lease asset and liability amortization over the lease term.

- Calculate Lease Expense: Use the lease expense calculator to calculate the lease expense for each period.

- Present on Financial Statements: Use the balance sheet and income statement templates to present lease assets, liabilities, and expenses on your financial statements.

Gallery of ASC 842 Lease Accounting Examples

FAQs on ASC 842 Lease Accounting

What is ASC 842?

+ASC 842 is a lease accounting standard introduced by the FASB to enhance transparency and comparability in financial reporting.

What are the benefits of using ASC 842 Lease Excel templates?

+ASC 842 Lease Excel templates can simplify the lease accounting process, automate lease accounting, ensure compliance with ASC 842, and improve financial reporting.

How do I use the ASC 842 Lease Excel template?

+To use the ASC 842 Lease Excel template, download the template, enter your lease data, classify your leases, calculate lease amortization and expense, and present on your financial statements.

Conclusion

ASC 842 Lease Excel templates can simplify the lease accounting process and ensure compliance with the new lease accounting standard. By using these templates, lessees can automate lease accounting, improve financial reporting, and reduce the risk of errors. We hope this article has provided valuable insights into the benefits of using ASC 842 Lease Excel templates and the free download link has been helpful. If you have any further questions or need assistance with implementing the template, please do not hesitate to contact us.

Share your thoughts: Have you used ASC 842 Lease Excel templates in your organization? Share your experiences and tips in the comments below.