Managing accounts receivable is a crucial task for any business, as it directly affects cash flow and overall financial health. To help you streamline your accounts receivable process, we've put together five free Excel templates that you can use to track and manage your outstanding invoices, payments, and customer credit limits.

Why Use Accounts Receivable Excel Templates?

Before we dive into the templates, let's quickly discuss why using Excel templates for accounts receivable management is a good idea:

- Cost-effective: Excel templates are free or low-cost, making them an attractive option for small businesses or those on a tight budget.

- Customizable: Excel templates can be easily customized to fit your specific business needs and requirements.

- Easy to use: Excel templates are user-friendly, even for those without extensive accounting experience.

- Scalable: Excel templates can grow with your business, allowing you to easily add new customers, invoices, and payments as needed.

Template 1: Accounts Receivable Tracker

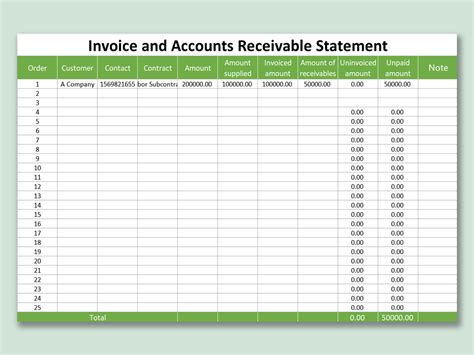

This template provides a simple and easy-to-use way to track outstanding invoices and payments. It includes columns for:

- Invoice number and date

- Customer name and contact information

- Invoice amount and due date

- Payment amount and date

- Outstanding balance

Template 2: Invoice Template with Payment Terms

This template includes a basic invoice template with space for payment terms, such as due date and late payment fees. It also includes columns for:

- Invoice number and date

- Customer name and contact information

- Invoice amount and description

- Payment terms and due date

- Late payment fees and charges

Template 3: Customer Credit Limit Tracker

This template helps you track customer credit limits and outstanding balances. It includes columns for:

- Customer name and contact information

- Credit limit and outstanding balance

- Payment history and due dates

- Overdue amounts and late payment fees

Template 4: Accounts Receivable Aging Report

This template provides a detailed aging report of outstanding invoices, helping you identify which invoices are overdue and which customers are at risk of default. It includes columns for:

- Invoice number and date

- Customer name and contact information

- Invoice amount and due date

- Aging category (e.g., 0-30 days, 31-60 days, etc.)

- Outstanding balance

Template 5: Accounts Receivable Dashboard

This template provides a comprehensive dashboard view of your accounts receivable, including metrics such as:

- Total outstanding balance

- Average days to pay

- Overdue amount and percentage

- Customer credit limit utilization

- Invoice payment history

Getting Started with Your Accounts Receivable Excel Templates

To get started with your accounts receivable Excel templates, simply follow these steps:

- Download the template(s) you want to use.

- Customize the template(s) to fit your business needs.

- Enter your customer and invoice data.

- Track and manage your outstanding invoices and payments.

- Use the data to make informed decisions about your business.

By using these free accounts receivable Excel templates, you'll be able to streamline your accounts receivable process, reduce the risk of late payments and bad debt, and improve your overall cash flow.

Gallery of Accounts Receivable Excel Templates

Frequently Asked Questions

What is accounts receivable?

+Accounts receivable refers to the amount of money that customers owe a business for goods or services provided on credit.

Why is accounts receivable important?

+Accounts receivable is important because it directly affects a business's cash flow and overall financial health. Proper management of accounts receivable can help reduce the risk of late payments and bad debt.

How do I customize the accounts receivable Excel templates?

+You can customize the accounts receivable Excel templates by adding or removing columns, changing the formatting, and entering your own data. You can also use Excel formulas and functions to automate calculations and analysis.