Managing cash flow is essential for the survival and success of any business. A well-planned cash flow management strategy can help businesses navigate financial challenges, make informed decisions, and achieve their goals. One tool that can aid in effective cash flow management is a 13-week cash flow template in Excel.

The Importance of Cash Flow Management

Cash flow management is the process of tracking the inflows and outflows of cash in a business. It involves monitoring and controlling the movement of cash to ensure that the business has sufficient funds to meet its financial obligations. Effective cash flow management can help businesses:

- Avoid cash shortages and financial difficulties

- Make informed decisions about investments and funding

- Identify areas for cost reduction and optimization

- Improve relationships with suppliers and customers

- Enhance overall financial performance and stability

What is a 13-Week Cash Flow Template?

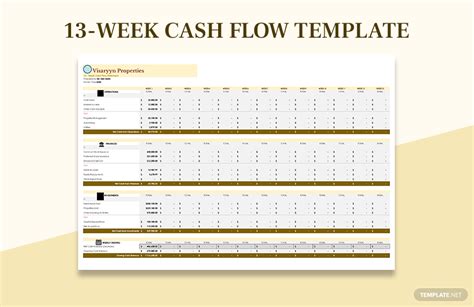

A 13-week cash flow template is a financial planning tool that helps businesses forecast and manage their cash flow over a 13-week period. The template typically includes columns for:

- Weeks 1-13: Forecasted cash inflows and outflows

- Beginning cash balance: The initial cash balance at the start of the 13-week period

- Net cash flow: The total cash inflows minus outflows for each week

- Ending cash balance: The projected cash balance at the end of each week

Using a 13-week cash flow template can help businesses:

- Identify potential cash shortages and surpluses

- Make adjustments to manage cash flow effectively

- Monitor and control cash flow on a weekly basis

- Make informed decisions about investments and funding

Benefits of Using a 13-Week Cash Flow Template

Using a 13-week cash flow template can provide numerous benefits to businesses, including:

- Improved cash flow management: The template helps businesses track and manage their cash flow effectively, reducing the risk of cash shortages and financial difficulties.

- Enhanced financial planning: The template enables businesses to forecast their cash flow and make informed decisions about investments and funding.

- Increased accuracy: The template provides a detailed and accurate picture of the business's cash flow, helping to identify areas for cost reduction and optimization.

- Better decision-making: The template provides businesses with the information they need to make informed decisions about cash flow management.

How to Use a 13-Week Cash Flow Template

Using a 13-week cash flow template is a straightforward process that involves the following steps:

- Download the template: Download a free 13-week cash flow template in Excel from a reputable source.

- Enter historical data: Enter the business's historical cash flow data into the template, including cash inflows and outflows.

- Forecast cash flow: Forecast the business's cash flow over the next 13 weeks, using historical data and other relevant information.

- Review and adjust: Review the template regularly and adjust the forecast as necessary to reflect changes in the business's cash flow.

- Monitor and control: Use the template to monitor and control the business's cash flow, making adjustments as necessary to ensure effective cash flow management.

Tips for Using a 13-Week Cash Flow Template

Here are some tips for using a 13-week cash flow template effectively:

- Use historical data: Use historical data to inform the forecast and ensure that the template is accurate and reliable.

- Be conservative: Be conservative when forecasting cash flow, as this will help to avoid cash shortages and financial difficulties.

- Review regularly: Review the template regularly to ensure that the forecast is accurate and up-to-date.

- Make adjustments: Make adjustments to the template as necessary to reflect changes in the business's cash flow.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using a 13-week cash flow template:

- Inaccurate forecasting: Inaccurate forecasting can lead to cash shortages and financial difficulties.

- Failure to review: Failure to review the template regularly can lead to inaccurate forecasting and poor cash flow management.

- Lack of conservatism: Lack of conservatism when forecasting cash flow can lead to cash shortages and financial difficulties.

Conclusion

A 13-week cash flow template is a valuable tool for businesses that want to manage their cash flow effectively. By using the template, businesses can forecast and manage their cash flow, make informed decisions about investments and funding, and avoid cash shortages and financial difficulties. By following the tips and avoiding common mistakes, businesses can get the most out of their 13-week cash flow template and achieve their financial goals.

FAQs

Q: What is a 13-week cash flow template?

A: A 13-week cash flow template is a financial planning tool that helps businesses forecast and manage their cash flow over a 13-week period.

Q: How do I use a 13-week cash flow template?

A: To use a 13-week cash flow template, simply download the template, enter your historical data, forecast your cash flow, review and adjust the template regularly, and use it to monitor and control your cash flow.

Q: What are the benefits of using a 13-week cash flow template?

A: The benefits of using a 13-week cash flow template include improved cash flow management, enhanced financial planning, increased accuracy, and better decision-making.

Q: Where can I download a free 13-week cash flow template?

A: You can download a free 13-week cash flow template from a reputable source, such as a financial website or a business planning resource.

Q: How often should I review my 13-week cash flow template?

A: You should review your 13-week cash flow template regularly, ideally on a weekly basis, to ensure that your forecast is accurate and up-to-date.

What is a 13-week cash flow template?

+A 13-week cash flow template is a financial planning tool that helps businesses forecast and manage their cash flow over a 13-week period.

How do I use a 13-week cash flow template?

+To use a 13-week cash flow template, simply download the template, enter your historical data, forecast your cash flow, review and adjust the template regularly, and use it to monitor and control your cash flow.

What are the benefits of using a 13-week cash flow template?

+The benefits of using a 13-week cash flow template include improved cash flow management, enhanced financial planning, increased accuracy, and better decision-making.